Want to know how to budget and save money with a family? However large or small your brood, we’ve got smart ways to save on family expenses (yes, groceries!) and plan ahead for your future.

The cost of raising children can easily put a strain on any family’s finances. When you consider the additional costs of necessities like food, clothing, and education, plus all the “extras”, it’s not surprising that couples often have to rethink their spending and saving strategies once they start a family.

Luckily, saving money while raising a family doesn’t have to require drastic steps. There needn’t be a complete lifestyle overhaul that cuts out things you cherish like family vacations, but instead, you need to gain control over your money and consciously plan for the future.

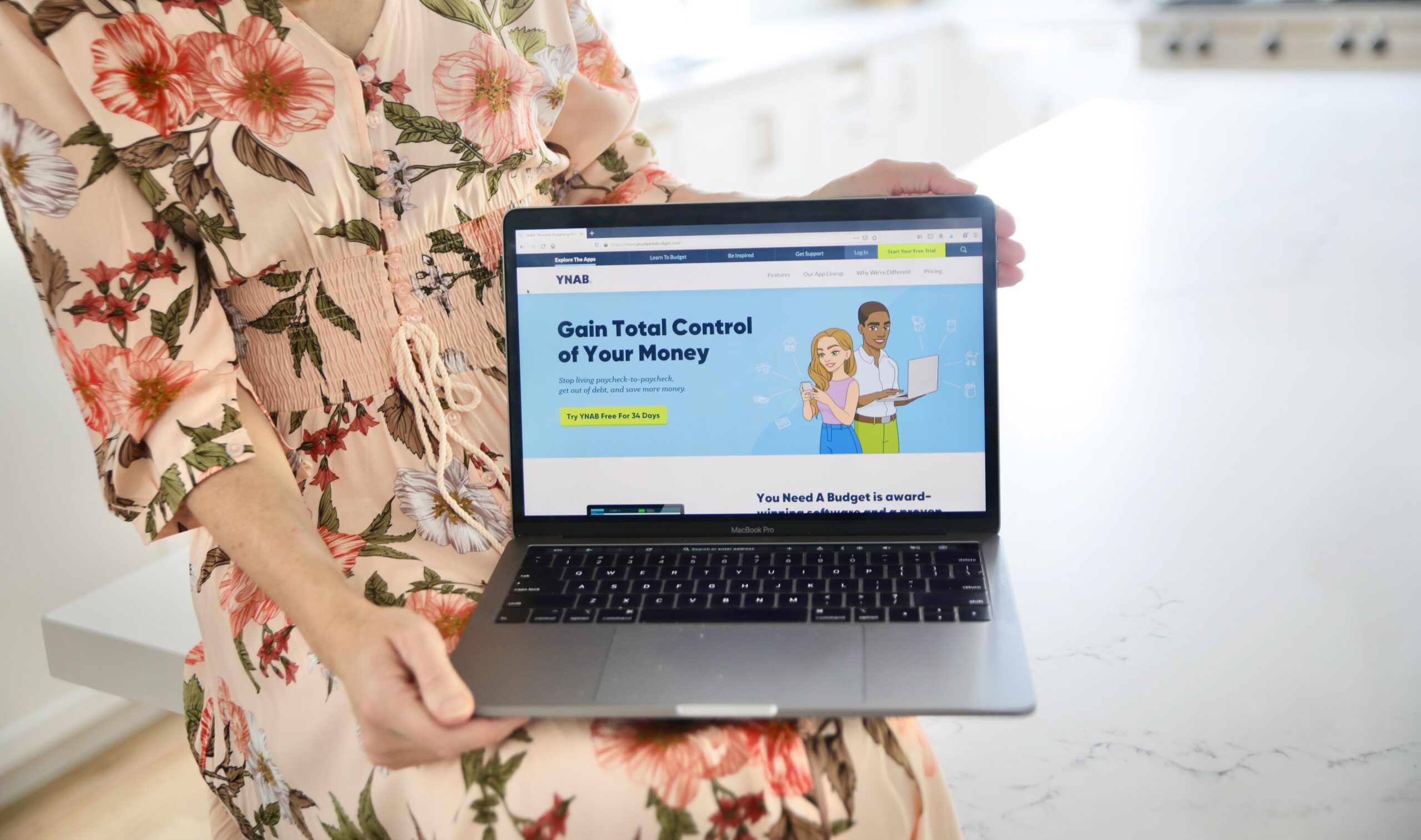

That’s why we’ve partnered with the award-winning personal finance software, You Need a Budget, to teach you how to create a forward-thinking budget, and use a combination of different dollar-stretching methods, to make a big difference to your bank account’s bottom line.

It might take a little getting used to, but if you commit to using our smart saving strategies, managing your money will soon become second nature, and you’ll be able to get ahead for good – reliving a lot of stress in the process!

PIN for when you’re ready to gain control over your money

SAVE BY USING A BUDGETING TOOL

The first step to gaining control over your finances is to create a budget. Not only will a budget allow you to see where your family’s money is going, it can help curb impulse buying and overspending, and give you the motivation you need to see how making small changes can positively affect your bottom line.

That being said, keeping a standard budget only allows you to see part of the picture: your monthly inflow vs outflow.

We believe the key to success with saving, is to transform your budget to become forward-thinking – so you’re not just looking at where your money went last month, but you’re also planning where your money should be going in the future.

In order to do this, we recommend using an online budgeting tool called You Need a Budget (YNAB). What we love about YNAB is that they transform your budget into a spending plan that’s not restrictive – it’s more of a lifestyle tool that allows you to consciously plan for the future and supports the pursuit of your dreams and aspirations.

Want to take your whole family on a beach getaway? Renovate your kitchen? Or finally pay off your student loans?

Whatever your financial goals may be, You Need a Budget can help you put a plan in place to get there.

YNAB teaches 4 simple rules that show you how to stop living paycheck-to-paycheck, get out of debt, and save more money so that you can spend it on the things that matter to you most.

On average, new budgeters using their software save $600 in their first 2 months, and $6,000 in their first year!

And we love that you can try YNAB for free for 34-days with NO credit card required.

In addition to their award-winning personal-finance software, YNAB offers free educational content, videos and live workshops every single day, making it easy to learn their method, and stay motivated.

YNAB’s Four Rules to Gain Control of Your Money:

- Give Every Dollar a Job. Know exactly how you want to spend the money you have available – and only the money you have right now – before you spend a dime. This helps ensure that you have money for the things that matter most to you. Think of your money as working for you, not sitting around idle.

- Embrace Your True Expenses. Figure out what you really spend, and treat those infrequent expenses (like twice-a-year car insurance, or replacing your laptop every two years) like monthly expenses in your monthly budget. Breaking big or uncommon expenses down means you won’t be surprised by them.

- Roll with the Punches. Accept that things change, and your budget needs to be flexible. You won’t spend the same amount on all categories every month, so be prepared to move money around. Moving money around doesn’t mean you are budgeting wrong, it means you are actually budgeting!

- Age Your Money. Break the paycheck-to-paycheck cycle by aiming to reach the point of using the money you earned last month to pay this month’s expenses. This margin will create more peace of mind than you can even imagine.

Give it a try for the next month (remember, they offer a free 34-day trial to get you started) and see what gaining control of your money really feels like. If you’re like us, you won’t ever want to manage your finances without YNAB again.

HOW TO SAVE ON ENTERTAINMENT

The average American household spends approximately 18% of its annual budget on food and entertainment, so we’ll start our money-saving tips with those 2 categories. Pick a combination of these strategies to try and you’ll soon see how they can add up.

TV

Drop Cable TV: Paying for cable TV adds up to hundreds of dollars a year. Many people don’t realize that you can enjoy the same shows from the big networks like FOX, CBS, ABC and NBC for free online.

Cable à la Cart: In the past you could only get access to channels like HBO and Showtime as an add-on to a larger cable package, but now you can pay à la carte for these premium channels. So if you mostly watch HBO, drop cable and pay for it separately.

Start Streaming: Selecting 1-2 streaming services like Netflix, Hulu, Amazon Prime and Disney+ is a great, cheaper alternative to cable, and you won’t have to sacrifice program quality. You’ll find plenty of movies, documentaries, and family-friendly shows to enjoy, for a fraction of the cost of cable.

Look for Free Streaming: Take advantage of free trial periods on streaming services to test them out, and get bonus entertainment. Many offer 1+ months for free, and Apple offers one year of Apple TV+ with the purchase of any Apple device.

Negotiate: If you decide you’d rather not live without cable, give your provider a call and see if you can negotiate a better rate. If there’s multiple providers in your area, shop around and get everyone’s best package, then bring that information to your current provider to see if they can beat it. You’ll find that they are quick to give out credits for free service, lower your package price, and/or offer additional premium channels for free to keep you as a customer.

Family Time

A trip to the movie theater or bowling alley with your family can get expensive in a hurry. While it’s a nice thing to do every once in a while, avoiding expensive days out is a great way to save money.

Fortunately, there are so many free or low-cost ways to entertain your kids. And at the end of the day, what kids really crave the most, is spending time with their family – not all the bells and whistles.

Entertain at Home:

- Keep a good stash of fun, family board games on hand and hold a weekly “Game Night”. Check out our favorites: Best Board Games For Kids & Families (That Aren’t Candy Land or Monopoly)

- Create an indoor obstacle course and see who can race through it with the fastest time. For creative ideas, see 87 Energy-Busting Indoor Games & Activities for Kids.

- Hold a fun, family Movie Night – make themed snacks based on the movie, and have everyone dress in their comfiest clothes.

- Grab a sprinkler and a $5 kiddie pool for summer-time fun. It will keep your kids entertained for just as long as your local pool (and no membership fee required!)

Get Some Fresh Air:

- Go for a family bike ride

- Find a new hiking trail to explore

- Pack a picnic and head to your local park

- Swim at a nearby pond or lake

- Find a new playground, splash pad or skate park to try

- Do an outdoor nature scavenger hunt (search for free printable hunts online)

Head to the Library: A trip to your local library is a great way to entertain your kids for free. Not only does it get everyone out of the house for a change of scenery, but you can come home with books, audiobooks, magazines and movies for further entertainment. Many will even have games and puzzles you can borrow. And check to see if your library has a kids’ story time, classes or other activities for families…you’ll be surprised how much they offer for free.

Get a Family Membership: Pick your favorite local zoo, aquarium, science center or museum and purchase a year-long family membership. If you go frequently, it can save you a lot of money in the long run. This is also a great gift idea for grandparents to purchase for birthdays or Christmas.

Be Smart with Outings: If you decide you’d like to do a bigger outing with your family, like heading to an amusement park or hitting the cinema, do your research beforehand to find savings. For example, if you’re going to the movie theatre, pick a late-morning or matinee showing and bring your own candy stash. Amusement parks often have discount coupons through your local travel bureau. Zoos and museums may have half-price admission days, or steep discounts for teachers, students or AAA card holders. Bring your own lunch and you won’t have to pay the inflated prices for chicken fingers. Bottom line: be smart and you’ll find savings.

Toys

Parents often look to toys as a major source of their kids’ entertainment, but you needn’t spend a lot of money on fancy, expensive toys for them to be happy. Here are a few ways you can save:

Buy For Longevity: If you’re going to spend money on toys, you want to make sure you’ll get your money’s worth with toys that they won’t use just once or twice, but rather ones that will continue to engage and entertain them for weeks, months and even years down the line. We work year-round testing toys with kids of all ages and stages, and recommend only the ones that repeatedly knock their socks off in our Toy Gift Guides for Kids. Take a peek and you’re sure to find the perfect toy for your child.

Rotate Toys: Kids can often tire of seeing the same toys every day, and having all of them out at once often becomes disorganized and overwhelming. Setting up a rotating system can breathe new life into the toys you already have, simply by putting them away for a few weeks, and then rotating them back into play. This will keep your kids consistently entertained, while preventing you from having to buy new toys.

Buy Used: Instead of paying for costly new toys, keep your eyes open for used ones via online sites like eBay, Mercari, Facebook Marketplace, and Facebook local buy/sell groups.

Sell: Once your children have outgrown a toy, if it’s in good condition, try selling it. Group similar type toys together and sell as a “lot” to cut down on the number of listings you have to manage.

HOW TO SAVE MONEY ON GROCERIES AND HOUSEHOLD ITEMS

Feeding a family can be expensive, to say the least, so saving on food can really make a difference to your bank account. Here are a few tips when shopping for groceries and other household necessities to help you along the way:

Buy in Bulk: Buying items in bulk from wholesale retailers like BJs or Costco can provide significant savings for larger families. However, only buy items in bulk that make sense for your habits. Perishables like fruit and vegetables will have to be consumed in a few days, or go to waste. But products with a longer shelf life like beans, pasta, cereal, and condiments can offer significant savings. Household items like paper towels, toilet paper, and toiletries also make good bulk purchases.

Subscribe and Save: For items that you need on a monthly basis, like vitamins, soap or diapers, use “subscribe and save” on Amazon or Target to save up to 15%, and they’ll automatically send you the product based on your designated schedule.

Buy Generic: Generic products can be identical to their brand-name competitors, but can be sold for a cheaper price. Essentially they haven’t been “marked up” for the name/packaging. Drug stores often carry generic versions of the most popular over-the-counter drugs for several dollars less. At the grocery store, look for the store-brand versions to save as well.

Grocery Shop Smart: People often think you have to be an extreme couponer to save at the grocery store, but there’s much more to it than that. With a little foresight and organization, and can save a lot of money on groceries. Some of our favorite tips include:

Meal Plan: Eliminate food waste and unnecessary purchases by planning your homecooked meals for the week. Having a meal plan will not only mean less nights getting expensive take-out, but will also ensure you only buy what you really need at the grocery store.

Write a List: Take your meal plan and write a list of all the ingredients you’ll need, then add your weekly necessities like milk and eggs. Keeping to this list while at the store will not only help ensure you get everything you need, but keep you on track and limit impulse purchases.

Go Meat-Free: Proteins like meat or fish are often the most expensive items in your grocery cart. Try cooking a vegetarian meal at least once a week to boost your savings – there are hundreds of delicious recipes to try online that don’t have to compromise taste!

Shop Solo: If you can swing it, shop solo. We find the more kids we bring along, the more items that end up in our cart! If that’s not possible, talk to them before you go into the store about how important it is that you stick to your list. If they’re old enough, you can even give them the job of crossing off the items as you find them which will keep them busy and engaged.

Get Groceries Delivered. If you’re notorious for impulse purchases, using online ordering services like Instacart can help. There will be a delivery fee, but you’ll save on gas, and will get only what you order…no extras like you might have picked up had you gone to the store yourself.

HOW TO SAVE MONEY AT RESTAURANTS

Taking your family to eat at restaurants each week can add up to hundreds, if not thousands, of dollars every year. While limiting dining out all together may not be feasible (or desirable for busy, stressed parents!), there are strategies you can use to save:

Budget for Meals Out: If you plan for a certain number of meals out in your budget (again, YNAB makes this easy), you’ll be prepared for the additional costs and can ear-mark your money specifically for it.

Kids Eat Free: A good amount of popular chain restaurants offer “kids eat free” deals during specific days/times of the week. A quick online search should give you various options in your area where you’ll only have to pay for your adult entrées.

Skip Dessert: Kids at restaurants often beg for dessert, and who can blame them! We’ve found that stashing a $3 carton of ice cream in the freezer and telling our kids “we’ll have dessert when we get home” is much cheaper, and just as fun.

Plan Your Meals: We find that we often end up at a restaurant when we’re too tired to think about what to cook for dinner, or don’t have enough food to make an entire meal. This is where meal planning can really help. If you make a weekly meal plan, you’ll be able to stock your fridge with all the ingredients you need, and will have a solid plan to put into place each night – resulting in less stress, and less eating out.

Make it Fun: Make eating at home more fun with weekly themed nights like Taco Tuesday or Meatless Monday. You’ll be less likely to want to go out, when dining at home is exciting too.

Make Ahead: Whenever possible, make a double-batch of any “freezable” dinners (think chili, soups, lasagna, etc.) so you have extras in-stock for those nights where you just can’t muster the energy to cook. You’ll then have these meals to pop in the microwave or oven, instead of heading to a restaurant.

HOW TO SAVE MONEY ON CLOTHES

Buying clothes for your family – especially for children who need new items each season (and growth spurt!) – can get pricey. Cut your costs with these smart strategies:

Follow the “30 x 3” Rule: Don’t buy an item of clothing unless you think you will wear it at least 30 times and it will go with at least three other items in your closet. This will help you avoid clothing that only go with a few other pieces, and make for a wardrobe that’s easier to mix and match.

Consider Neutrals: When buying for young kids, especially babies, buy a majority of their staples in neutral colors. This way you can easily pass them down between siblings, no matter the gender. This is particularly important with more expensive items like winter jackets and shoes.

Shop Ahead: Take advantage of end-of-the-season markdowns and shop ahead for the next year, buying clothes 1-2 sizes larger than their current size.

Shop Second Hand: Head to your local consignment store or search online via Facebook groups/Marketplace, eBay, poshmark or ThredUp. Many of these sites offer big brand names at a fraction of the retail cost.

Buy Good-Quality Staples: Paying a little extra for higher-quality can save you money in the long run, as they’ll last longer and won’t have to be replaced. We especially recommend this strategy with first children, as their clothes will be passed down for each subsequent child (take note of our “consider neutrals” tip above as well!).

Sell Old Clothes for Cash: Use popular sites like Poshmark and ThredUp to sell clothes and accessories you no longer want.

HOW TO SAVE MONEY ON GIFTS/CELEBRATIONS

As your family grows, you’ll find yourself spending more and more money on celebrations like birthday parties and holiday gifts. Luckily these celebrations can be marked on a calendar and planned for (again, the forward-thinking of YNAB’s spending plan can help you earmark money for such events so your budget isn’t taken by surprise), and the tips below can reduce your overall costs:

Give the Gift of Time: As parents we often think our children’s joy on their birthday or at the holidays is linked to new toys and physical gifts, but giving them one-on-one time with you will ultimately bring them more smiles and memories. Our free printable Coupon Book includes fun coupons for small outings both inside and outside the house, that won’t cost much, and will build stronger relationships in the process.

Try the Want/Need/Wear/Read Rule: Select gifts carefully and pick something they want, something they need, something they’ll wear and something they’ll read.

Use Cashback Sites: Download the Rakuten extension on your browser and whenever you make an online purchase through a major retailer, it will pop-up and offer you a percentage of your money back. There is no catch or hidden fees (they essentially get commission for “sending” you to the site, and split it with you). If you do this throughout the year, you’ll have a nice stash of extra money to use for gifts.

Shop Sales Wisely: If you see something that would make a great gift (any of the games on our Best Board Games Gift Guide or craft sets in our Arts & Crafts Gift Guide for instance) on sale for a deep discount, pick up a few to keep on hand for birthday parties. You’ll ultimately save some cash, and always having gifts on hand will save you time and stress later. Use after-holiday sales to stock-up on wrapping paper and supplies too!

Skip the Fancy Venue: A large portion of the cost for kids’ birthday parties comes from holding it at a venue – whether it be a bowling alley, trampoline park or Chuck-E-Cheese. A simple at-home party with a few friends can be just as memorable. Try a “sleep under” where kids come in their PJs and watch a movie, or let them decorate their own cupcakes. Don’t want the stress of holding it at your house? Meet at a local park for a picnic and play session.

SAVE BY BEING ENERGY EFFICIENT

Did your parents ever nag you to turn off the lights and take quick showers? Well, they were right. Save energy, and you’ll save money.

Get an Energy Audit: An energy audit is a great way to find out where your energy “leaks” are in your home, and receive information on how to fix them. Contact your utility company and see if they offer a free audit – many do!

Do it the Old-Fashioned Way: Turning off lights, unplugging your appliances when not in use, taking quick showers, and not running your laundry machine or dishwasher until it’s full, will save you energy and lower your utility bills.

Use a Programmable Thermostat: These smart devices will allow you to set your thermostat so it automatically dips to a lower temperature for times when you’ve left the house or are sleeping, and raise it to be more comfortable when you’re home. These can drastically reduce your heating and cooling costs.

Install LED Lightbulbs: LED lightbulbs are 90% more efficient than their traditional incandescent counterparts (thereby reducing your energy bill), and also last much longer (thereby reducing replacement costs). A win-win in our book!

SAVE BY KNOWING WHEN TO BUY

Do Your Homework: Although it can be tempting to buy something right off the shelf, if it’s a pricey item, you should step away and make sure you do your homework first. Do a web search to do a quick price comparison, see if there are any coupons available, or even check local Facebook groups or resale sites to see if you can buy the item second-hand.

Buy Off-Season: Retailers will mark-down seasonal items at the end of the season, so buying next year’s winter clothing or a new pair of skis in late winter when those items go on clearance is your best bet for savings. Need a new patio set? You’ll save hundreds if you buy towards the end of the summer. This requires a lot of planning and foresight, but can save you a lot of cash.

ADDITIONAL WAYS FOR FAMILIES TO SAVE

Take Care of Your Family’s Health: We all know that for your overall health and longevity, it’s important to take care of your body – but keeping yourself healthy also has financial implications. Eating clean and staying active will not only keep you out of the doctor’s office (and off pricey medications), but will also boost your energy levels, which can ultimately lead to greater productivity in the workplace, and at home.

Use the 30-day Rule: When considering a big purchase, wait 30 days before you move forward. You’ll be surprised how many purchases you end up NOT making because of the time you took to really consider how it would fit (or not fit) into your life.

Have a Yearly Clean-Out: Every year, go through your house and sell items you no longer need. Weed through your closets, organize the kids’ toys, and go through your attic/basement. Hold a garage sale or post online to earn a little extra money.

Check your Credit Card for Extras: Many credit cards come with surprising rewards, like free roadside assistance, or complimentary subscriptions to services like Lyft or DoorDash.

Automate Coupons: Use browser extensions like Rakuten’s Cash Back Button to easily find coupon codes and earn cash back on your online purchases.

Negotiate Your Bills: You’d be surprised at how many companies are willing to negotiate your monthly payments or offer extras as freebies to keep you as a customer. Give your credit card company, cable service, phone company, insurance and gym a call to see what they have to offer.

Cancel Services You Don’t Use: Once or twice a year, dive into your costs and see where you can cut. Are you not using the gym but still paying for a membership? Have a landline phone but always using your cell phone? Watching all streaming services and not a ton of cable? Still getting magazines that you never have a chance to read? Chances are you have at least one service you could cancel without it making a huge impact to your happiness.

Have a No-Spend Challenge: Challenge yourself (and your family) to have a No-Spend week where you can’t buy anything that isn’t deemed essential. Keep increasing the timeframe and see if you can complete the challenge for a month.

By using smart online software to budget, plus our smart saving tips, you’ll be able to better manage your money while not feeling restricted. And instead of stressing about your finances, you’ll have more care-free time to spend with your family.

Thanks again to our sponsor, You Need a Budget, for helping parents gain control of their money and teaching them how to stop living paycheck-to-paycheck, get out of debt, and save more money for the things that matter to them most. Sign up for their free 34-day trial (no credit card required!) to start saving.

Budgeting in a big family is essential! Even though I may not be saving money on spending, my budget is not never-ending. Each month I categorize my spending and calculate it, making a rough plan for the next month. It’s not ideal, but it works for me.

I will definitely find ways to apply your tips to my budgeting! Thanks!